Loading

Get Nd Form Nd-1ext 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ND Form ND-1EXT online

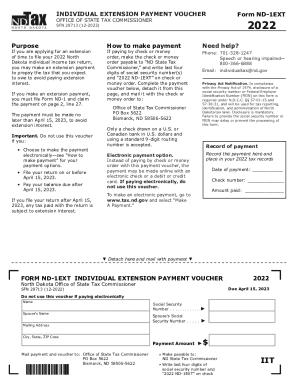

Filling out the ND Form ND-1EXT is an essential step for individuals seeking an extension for their 2022 North Dakota income tax return. This guide provides clear, step-by-step instructions to help you seamlessly complete the form online.

Follow the steps to fill out the ND Form ND-1EXT online

- Click ‘Get Form’ button to obtain the form and open it in your editing tool.

- Enter your full name in the 'Name' field. If you are married and filing together, include your partner’s name in the 'Spouse's Name' field.

- Provide your complete mailing address, including city, state, and ZIP code, in the 'Mailing Address' section.

- Fill out your Social Security number and your spouse's Social Security number in the designated fields.

- Indicate the payment amount you are expecting to make for the extension right next to 'Payment Amount'.

- Ensure that you check the form for accuracy and completeness before finalizing it.

- Save your changes, download the form, and prepare it for printing or sharing.

- Detach the payment voucher section from the form if you are submitting a check or money order.

- Mail the payment and the voucher to the address provided on the form, ensuring all details are included.

Complete your ND Form ND-1EXT online today and ensure your extension payment is processed on time.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

An individual is allowed an income tax credit for making one or more charitable contributions totaling at least $5,000 to a qualified endowment fund.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.