Loading

Get Nj Form Nj-2210 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NJ Form NJ-2210 online

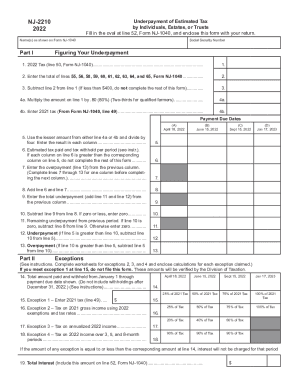

Filling out the NJ Form NJ-2210 online can help you determine if you are subject to interest on underpayment of estimated tax. This guide offers clear, step-by-step instructions to assist you in completing each section of the form accurately.

Follow the steps to successfully fill out the NJ Form NJ-2210 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling in your name(s) as shown on Form NJ-1040, along with your Social Security number. This information is essential for identification.

- Proceed to Part I, where you will calculate your underpayment. Start with line 1, entering your 2022 tax from line 50 of Form NJ-1040.

- Continue to line 2 and enter the total from lines 55 through 65 of Form NJ-1040. Ensure all relevant deductions and credits are included.

- On line 3, subtract line 2 from line 1. If the result is less than $400, you can stop here as further completion of the form is unnecessary.

- For lines 4a and 4b, calculate the necessary multipliers based on your tax information to assess your estimated tax obligation.

- In line 5, take the lesser amount from lines 4a or 4b, divide the result by four, and enter it in each payment column.

- On line 6, record the estimated tax paid and tax withheld for each period, ensuring it aligns with the tax obligations. If any column exceeds its counterpart on line 5, you do not need to complete the rest of the form.

- Continue to line 7, adding your overpayment from the previous column and computing the totals accordingly.

- Conclude Part I by filling lines 12 and 13 to finalize your assessment of underpayment and any exceptions that may apply.

- Move to Part II to check for potential exceptions from interest penalties. Each line requires specific calculations based on your tax profile.

- Once the form is fully completed, save your changes. You can then download, print, or share the form as needed.

Complete your NJ Form NJ-2210 online to ensure accurate tax filing and avoid penalties.

Related links form

Reporting Underpaid Estimated Tax o Exception 1: If you filed a full-year return in the previous year and you timely pay at least 100% of your previous year's liability through four equal estimated payments and/or withholdings, you can avoid an installment interest charge. This is known as the Safe Harbor provision.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.