Loading

Get Ma Dor M-990t 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MA DoR M-990T online

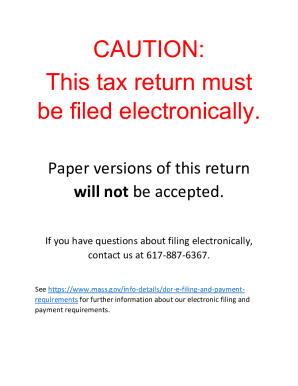

Filing the MA DoR M-990T online is crucial for ensuring compliance with Massachusetts tax regulations. This guide provides detailed, user-friendly instructions for successfully completing the form, designed for users of all experience levels.

Follow the steps to complete the MA DoR M-990T online

- Click the ‘Get Form’ button to access the MA DoR M-990T form and open it in the online platform.

- Begin by entering your name in the designated field, followed by your federal identification number. Make sure to accurately input your mailing address, including city or town, state, and zip code.

- Provide your phone number for contact purposes, along with the name of your treasurer in the respective fields.

- If you are enclosing a Taxpayer Disclosure Statement, indicate this by filling in the appropriate oval.

- Indicate if there is a federal amendment, audit, or if this is a final return by filling in the respective sections.

- Begin the excise calculation by entering the unrelated business taxable income from U.S. Form 990T, Schedule A, in the labeled field.

- Follow with any allowed deductions, including foreign, state, or local taxes, and report any adjustments, such as depreciation, as specified in the form.

- Continue completing the sections regarding miscellaneous adjustments, income subject to apportionment, and income apportionment percentages associated with calculations.

- Fill in the taxable income before net operating loss deduction, and complete additional calculations leading to the excise due.

- Once all sections are filled, review your entries for accuracy. You can save your changes, download the completed form, or print it for your records.

Complete your MA DoR M-990T online today to ensure timely filing and compliance.

Who must file Form 990-T? Exempt organizations that file Form 990, 990-EZ, or 990-PF and have a gross income of $1,000 or more from unrelated business income for the tax year must e-file Form 990-T.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.