Loading

Get Dc Schedule H 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DC Schedule H online

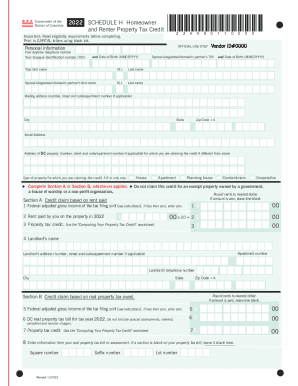

This guide provides a comprehensive walkthrough for completing the DC Schedule H form online. Designed for individuals with varying levels of experience, these instructions ensure a smooth filing process for the Homeowner and Renter Property Tax Credit.

Follow the steps to successfully complete your Schedule H online.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Begin by entering your personal information, including your name, mailing address, and taxpayer identification number (TIN). Ensure that you input the correct details for your spouse or registered domestic partner, if applicable.

- Indicate the address of the DC property for which you are claiming the credit. If it differs from the mailing address, provide the appropriate details.

- Select the type of property you are claiming the credit for: house, apartment, rooming house, or condominium. Ensure to fill in only one option.

- Choose to complete either Section A, for claims based on rent paid, or Section B, based on real property tax paid, as appropriate to your situation.

- For Section A, enter your federal adjusted gross income, the rent you paid during the year, and calculate your property tax credit using the provided worksheet.

- If using Section B, enter the federal adjusted gross income and the DC real property tax you paid for the tax year. Again, utilize the worksheet for calculating your credit.

- Fill in landlord information in either section as required, including their name, address, and telephone number.

- Review all information entered for accuracy before finalizing your submission.

- Once completed, save your changes, and choose to download, print, or share your Schedule H form as necessary.

Complete your DC Schedule H form online today for potential tax credits!

Once a DC resident reaches the age of 65, they can file an application for senior citizen property tax relief. If the adjusted gross income of the household is less than $139,900, they will be eligible for significant tax relief. Specifically, the property tax owed will be reduced by 50 percent.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.