Loading

Get Ar Dfa Ar1000d 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AR DFA AR1000D online

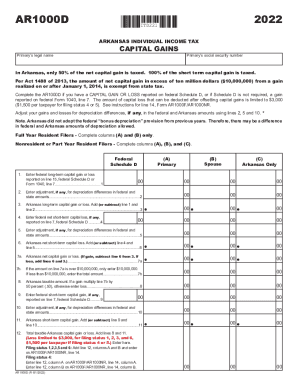

The AR DFA AR1000D form is essential for reporting capital gains or losses in Arkansas. This guide provides step-by-step instructions for filling out the form online, ensuring a smooth and accurate submission process.

Follow the steps to successfully complete the AR DFA AR1000D online.

- Click the ‘Get Form’ button to obtain the AR DFA AR1000D form and open it in the viewer.

- Enter your primary legal name as listed on official documents in the designated field.

- Input your social security number in the next section to verify your identity.

- If you have a capital gain or loss to report, complete the relevant sections based on your federal Schedule D.

- Fill out column (A) for full year resident filers or columns (B) and (C) for nonresident or part-year resident filers as instructed.

- Add your federal long-term capital gain or loss as indicated from your Schedule D, line 15.

- Any adjustments for depreciation differences between federal and state amounts should be entered in the appropriate fields.

- Proceed to calculate your Arkansas net capital gain or loss by following the specified addition or subtraction rules.

- Keep track of your calculations and ensure that the amounts entered are accurate, particularly those over $10,000,000.

- Once all fields are filled, verify your entries and make any necessary edits.

- Finally, save your changes, download the completed form, and print or share it as needed.

Complete your documents online to ensure compliance and accuracy.

Long-term capital gains come from assets held for over a year. Short-term capital gains come from assets held for under a year. Based on filing status and taxable income, long-term capital gains are taxed at 0%, 15% and 20%. Short-term gains are taxed as ordinary income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.