Loading

Get Ar Ar1075 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AR AR1075 online

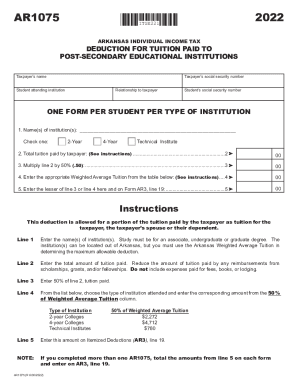

The AR AR1075 form is used for claiming a deduction for tuition paid to post-secondary educational institutions in Arkansas. This guide will provide you with a clear, step-by-step approach to filling out the form online, ensuring you capture all necessary information accurately.

Follow the steps to efficiently complete the AR AR1075 online.

- Click the ‘Get Form’ button to access the AR AR1075 form, allowing you to open and fill it out online.

- Enter the taxpayer's name in the designated field to identify the person claiming the deduction.

- Input the taxpayer's social security number, ensuring it is accurate for proper identification.

- Specify the relationship to the taxpayer in the provided section, clarifying their connection.

- Fill in the student's name who is attending the post-secondary institution.

- Enter the student's social security number to link them to the educational expenses.

- List the name(s) of the institution(s) attended by the student in line 1, ensuring that the institution can be located out of Arkansas if necessary.

- Indicate the type of institution attended by checking the appropriate box for 2-Year, 4-Year, or Technical Institute.

- In line 2, input the total amount of tuition paid by the taxpayer, deducting any reimbursements from scholarships, grants, or fellowships.

- Calculate 50% of the tuition paid and enter the figure in line 3.

- From the provided table, choose the appropriate Weighted Average Tuition for the institution type and input that amount in line 4.

- In line 5, enter the lesser amount between line 3 or line 4, which will be carried over to Form AR3, line 19.

- If more than one AR1075 form was completed, total the amounts from line 5 of each and enter that total on AR3, line 19.

- Review all entered information for accuracy before proceeding to save, download, print, or share the completed form.

Start completing your AR AR1075 online today for a smoother filing experience.

Arkansas also has a 1.0 to 5.30 percent corporate income tax rate. Arkansas has a 6.50 percent state sales tax rate, a max local sales tax rate of 6.125 percent, and an average combined state and local sales tax rate of 9.46 percent. Arkansas's tax system ranks 40th overall on our 2023 State Business Tax Climate Index.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.