Loading

Get Ar Ar2210a 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AR AR2210A online

Filling out the AR AR2210A form online can seem daunting, but with clear guidance, you can navigate the process seamlessly. This comprehensive guide will walk you through each section of the form, ensuring you have all the information needed to complete it accurately.

Follow the steps to successfully complete the AR AR2210A online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your primary legal name as it appears on your official documents in the designated field.

- Next, input your social security number in the appropriate field to verify your identity.

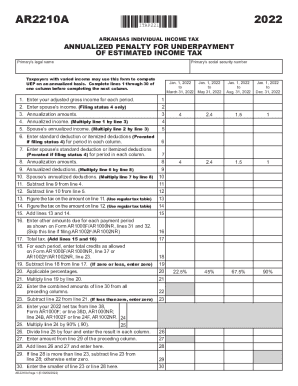

- Proceed to complete lines 1 through 30 for each applicable income period. Make sure to complete one column fully before continuing to the next.

- For line 1, enter your adjusted gross income for the specified period. If filing jointly, also fill in your spouse’s income on line 2.

- Calculate the annualization amounts on line 3, which will be used in subsequent calculations.

- Compute your annualized income by multiplying your adjusted gross income (line 1) by the annualization amount (line 3) and enter the result on line 4.

- Complete the same steps for your spouse’s annualized income, entering the result on line 5.

- Continue by entering your deductions. On lines 6 and 7, provide either your standard deduction or itemized deductions prorated for the specific period.

- Calculate the annualized deductions by multiplying the entries from lines 6 and 7 by the annualization amount, placing results in lines 9 and 10.

- Subtract line 9 from line 4 to determine your adjusted income tax, noted on line 11.

- Add lines 13 and 14 together for total tax owed on line 15, followed by entering any additional amounts due from previous forms (line 16) and summing them for total tax on line 17.

- Continue filling out the form by calculating underpayment amounts and applicable percentages through lines 18 to 30, ensuring all calculations reflect your specific income for each period.

- Finally, after filling in all fields accurately, save your changes and download the completed form. Printing or sharing options will also be available as needed.

Take the first step towards completing your AR AR2210A form online and ensure your taxes are filed correctly.

If your current year total tax minus the amount of tax you paid through withholding is less than $1,000, you are not required to pay the underpayment penalty and do not need to complete Form 2210. Different rules apply if at least two-thirds of your income is from farming or fishing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.