Loading

Get La Dor R-210r 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the LA DoR R-210R online

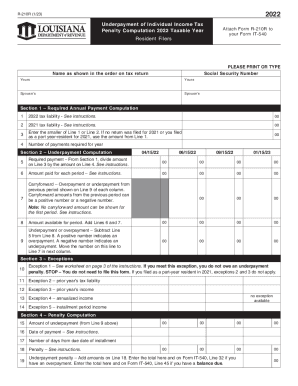

Filling out the LA DoR R-210R form is essential for residents to compute penalties for underpayment of individual income tax. This guide provides clear, step-by-step instructions to help users navigate the form effectively.

Follow the steps to complete the LA DoR R-210R online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your name and Social Security number as shown on your tax return. Ensure accuracy to avoid processing delays.

- In Section 1, compute your required annual payment. Begin by inputting your 2022 tax liability on Line 1. Next, enter your 2021 tax liability on Line 2. On Line 3, record the smaller amount between Line 1 and Line 2.

- Continue in Section 1 by entering the number of payments required for the year on Line 4.

- Move to Section 2, where you will compute underpayments. On Line 5, take the amount from Line 3 and divide it by the number from Line 4.

- Input the amount you paid for each period in Line 6 according to the due dates provided in the form.

- On Line 7, note any carryforward amounts from the previous period. Remember, no carryforward amount can be shown for the first period.

- Add the amounts from Lines 6 and 7 to get the amount available for the period on Line 8.

- To determine your underpayment or overpayment on Line 9, subtract Line 5 from Line 8. A positive number indicates an overpayment, while a negative number denotes an underpayment.

- Proceed to Section 3 and check for any exceptions that may apply. Input the relevant exceptions if necessary.

- In Section 4, enter the amount from Line 9 in Line 15. Follow the instructions to fill out the rest of this section, which involves computing penalties.

- Once all sections are filled out, you can save changes, download, print, or share the completed form as needed.

Complete your LA DoR R-210R form online today to ensure compliance with tax obligations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Minimum Gross Income Thresholds for Taxes Single and under age 65: $12,950. Single and age 65 or older: $14,700. Married filing jointly and both spouses are under age 65: $25,900. Married filing jointly and one spouse is age 65 or older: $27,300. Married filing jointly and both spouses are age 65 or older: $28,700.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.