Loading

Get La R-210nr 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the LA R-210NR online

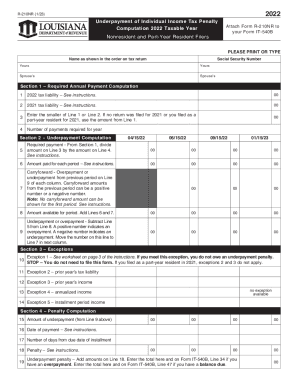

Filling out the LA R-210NR form can seem daunting, but with the right guidance, it's a straightforward process. This guide provides step-by-step instructions to help you complete the Underpayment of Individual Income Tax Penalty Computation for nonresident and part-year resident filers accurately and efficiently.

Follow the steps to complete the LA R-210NR form online.

- Click ‘Get Form’ button to access the form and open it in your online editor.

- Fill in your name as it appears on your tax return in the designated field. Ensure accuracy to avoid processing delays.

- Enter your Social Security Number in the appropriate field, checking that each digit is correctly placed.

- Navigate to Section 1 and calculate your 2022 tax liability. Input this figure on Line 1, following any relevant instructions provided.

- Next, record your 2021 tax liability on Line 2. If you did not file for 2021 or were a part-year resident, use the amount from Line 1 instead.

- On Line 3, enter the smaller value from Line 1 or Line 2. This will determine your required annual payment computation.

- Specify the number of required payments for the year on Line 4 based on your calculated figures.

- Proceed to Section 2 to compute the underpayment amount. On Line 5, divide the amount from Line 3 by the amount on Line 4 to ascertain your required payment.

- On Lines 6 and 7, input the amounts you have paid for each period as directed, while ensuring to include any carryforward amounts for the respective periods.

- Calculate the amount available for each period by adding Lines 6 and 7, entering the results on Line 8.

- Determine your underpayment or overpayment by subtracting Line 5 from Line 8. Record this amount on Line 9 for each corresponding period.

- Move to Section 3 and review the exceptions. If you qualify for any exceptions, follow the instructions and indicate accordingly.

- In Section 4, complete the penalty computation by adding the amounts from Line 9 and entering the penalty on the final lines as instructed.

- Once you have filled in all sections accurately, save your changes, and select the options to download, print, or share the completed form as needed.

Complete your LA R-210NR form online today to ensure timely filing and compliance.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Who Is Required to File? Louisiana law requires every resident and non-resident with Louisiana income to file individual income taxes. The residents pay taxes on all income earned, as long as they lived in Louisiana at least 6 months of the year or have Louisiana as their permanent residence.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.