Loading

Get La Dor R-19027 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the LA DoR R-19027 online

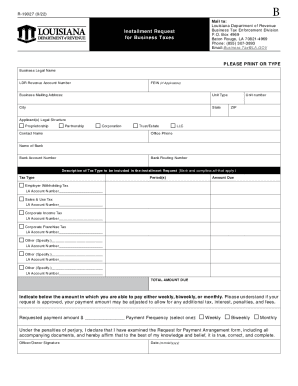

The LA DoR R-19027 form, known as the Installment Request for Business Taxes, allows taxpayers to request monthly installments if they cannot pay their full tax balance by the due date. This guide provides comprehensive instructions to complete the form accurately and efficiently online.

Follow the steps to complete the form online

- Click ‘Get Form’ button to access the R-19027 document and open it in your preferred editor.

- Fill in your business legal name and LDR revenue account number at the top of the form. Ensure accuracy in these fields as they are critical for identification.

- Provide the Federal Employer Identification Number (FEIN) if applicable. This information helps in accurately identifying your business.

- Complete the business mailing address section, including the unit type, city, state, unit number, and zip code.

- Indicate your applicant legal structure by selecting from options such as proprietorship, partnership, corporation, trust/estate, or LLC.

- Provide the contact name and office phone number of the person handling the installment request.

- Specify the name of the bank, the bank account number, and the bank routing number needed for the payment processing.

- Mark and fill in all applicable tax types and periods to be included in the installment request, along with the amounts due.

- Enter the total amount due from all listed taxes and indicate the amount you can pay, choosing a payment frequency of weekly, biweekly, or monthly.

- Read the declaration statement carefully. Under the penalties of perjury, you must affirm the information is true, correct, and complete before signing.

- Sign and date the form in the designated areas to validate your request.

- For the bank debit application section, print or type your business legal name, trade name, and provide necessary banking details as specified.

- Lastly, save your changes. You can download, print, or share the completed form as needed to ensure submission via your chosen method.

Complete your LA DoR R-19027 form online and submit it to manage your business tax payments effectively.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Station Overview. If you need to file a paper tax return, consider sending it by certified mail, with a return receipt. This will be your proof of the date you mailed your tax return and when the IRS received it. You may also use certain private delivery services designated by the IRS.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.