Loading

Get Nm Trd Pit-x Instructions 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NM TRD PIT-X Instructions online

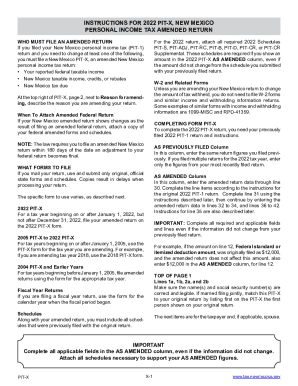

The NM TRD PIT-X Instructions guide you through the process of filing an amended personal income tax return in New Mexico. This document is essential for users who need to correct information previously submitted in their PIT-1 return.

Follow the steps to accurately complete your NM TRD PIT-X Instructions online.

- Press the ‘Get Form’ button to access the PIT-X form and open it for editing.

- Verify that your name(s) and social security number(s) are correct and legible at the top of page 1.

- In the AS PREVIOUSLY FILED column, enter the figures from your most recently filed PIT-1 return.

- In the AS AMENDED column, input the corrected amounts starting from line 30, according to the original instructions.

- Complete lines 1c, 1d, and 1e to indicate your federal tax status and residency.

- Enter your reason for amending your return in the designated field on page 2.

- If applicable, fill out lines 1f and 2f with your date of birth.

- Provide your current mailing address and notify changes by marking the checkbox on line 3a.

- If additional information is needed, attach a separate statement indicating that an attachment exists.

- Once all required fields are completed, review your entries for accuracy and completeness.

- Save your changes, download or print the completed form as needed.

- You can share your completed form if necessary.

Start completing your NM TRD PIT-X Instructions online now for a seamless filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

It would give $750 to single tax filers and $1,500 to married individuals filing joint returns, heads of households, and surviving spouses. The rebates would be based on 2021 returns, rather than 2022 returns to make processing faster.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.