Loading

Get Wi Dor Schedule Cc 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WI DoR Schedule CC online

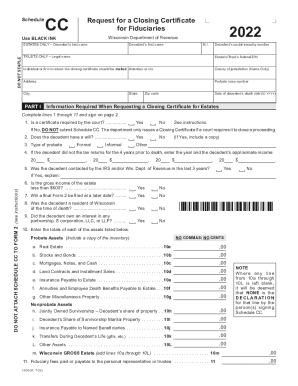

Filling out the WI DoR Schedule CC is an essential step for requesting a closing certificate for estates and trusts. This guide will provide you with clear, step-by-step instructions to ensure a smooth and accurate completion of the form.

Follow the steps to successfully complete the WI DoR Schedule CC.

- Press the ‘Get Form’ button to access the Schedule CC form and open it for editing.

- Enter the decedent's last name, first name, middle initial, and social security number in the designated fields. For trusts, use the legal name and the estate's or trust's federal Employer Identification Number (EIN).

- Provide the individual or firm’s name to which the closing certificate should be mailed, along with their address, including attention or c/o, county of jurisdiction, city, state, and zip code.

- Enter the date of the decedent’s death in the format MM DD YYYY.

- In Part I, answer whether a certificate is required by the court. If no, do not submit the Schedule CC.

- Indicate if the decedent had a will and specify the type of probate. If the decedent did not file tax returns for the four years before death, document the pertinent years and the approximate income.

- Indicate if the decedent had any correspondence with the IRS or the Wisconsin Department of Revenue in the last three years and provide explanations if applicable.

- Answer whether the gross income of the estate is less than $600 and if a final Form 2 will be filed at a later date.

- Respond to questions regarding the residency of the decedent at the time of death and their ownership interests in partnerships, S corporations, LLCs, or LLPs.

- Fill in the total values of each asset category listed (real estate, stocks and bonds, etc.) and ensure all necessary figures are entered without commas or cents.

- In Part II, repeat similar steps for trusts, indicating if a closing certificate is required by the court, including details about the trust and its funding.

- Make sure to sign the document, providing your contact information and return address.

- Once all fields are accurately filled, save your changes and download, print, or share the Schedule CC as required.

Complete your Schedule CC online today and ensure all necessary documents are properly submitted!

Use this form for a prior year return or if you need more information on your current year tax return. If filed electronically, most refunds are issued in less than three weeks. Filing a paper return could delay your refund. Our strong fraud and error safeguards could delay some refunds up to 12 weeks.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.