Loading

Get Mt Cit (clt-4) 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MT CIT (CLT-4) online

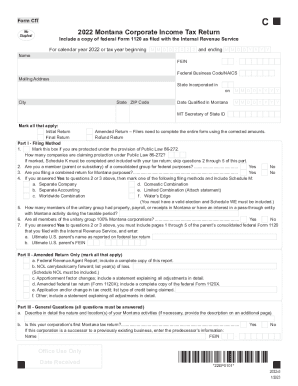

Filling out the MT CIT (CLT-4) form online can streamline the process of submitting your corporate income tax return for Montana. This guide will provide you with step-by-step instructions to ensure that the form is completed accurately and efficiently.

Follow the steps to successfully complete your MT CIT (CLT-4) online.

- Click the ‘Get Form’ button to access the MT CIT (CLT-4) document in the editor.

- Begin by entering your corporation's name, FEIN, and contact information as required in the top section of the form. Ensure that the federal business code/NAICS is correctly filled out to identify your business activities.

- Complete Part I for filing method selection. Indicate whether the return is initial, amended, or final by marking the appropriate boxes. If applicable, answer questions regarding Public Law 86-272 and group filings.

- Move to Part II, which is specifically for amended returns. Here, mark all relevant boxes indicating the reason for the amendment and provide necessary documentation.

- In Part III, answer all general questions regarding your corporation's activities in Montana. This includes detailing your corporation's first return in Montana and any previous statuses like withdrawals or mergers.

- Proceed to the computation section to calculate Montana taxable income. Follow the prompts to report taxable income from your federal return, along with any additions and reductions according to tax guidelines.

- Complete the Schedule K for apportionment factors if your corporation is a multi-state taxpayer. Enter average values for property, payroll, and receipts to determine how income is allocated in Montana.

- If applicable, fill out the Schedule M for affiliated entities, documenting any relationships with other business entities that may affect your tax filings.

- Ensure that all relevant schedules and forms, like Schedule C for tax credits, are included with your submission. Be thorough to avoid delays in processing.

- Finally, review the completed form for accuracy, save your changes, and proceed to download or print a copy of the MT CIT (CLT-4) for your records before submitting it online.

Get started on filing your documents online today!

= $ Single TaxpayerMarried Filing JointlyCapital Gain Tax Rate$0 – $44,625$0 – $89,2500%$44,626 – $200,000$89,251 – $250,00015%$200,001 – $492,300$250,001 – $553,85015%$492,301+$553,851+20% Jan 11, 2023

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.