Loading

Get Ks K-59 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KS K-59 online

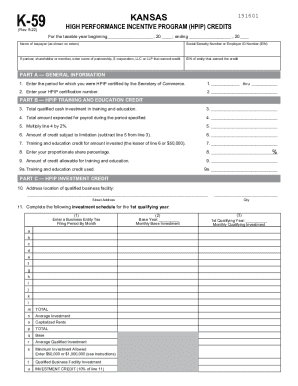

The KS K-59 form is essential for businesses participating in the Kansas High Performance Incentive Program (HPIP). This guide provides a step-by-step approach to filling out the KS K-59 online, ensuring a smooth and accurate completion of the form.

Follow the steps to fill out the KS K-59 accurately.

- Click the ‘Get Form’ button to access the KS K-59 document and open it in the online editor.

- Enter the taxable year’s starting and ending dates in the designated fields. Ensure the format is consistent for clarity.

- Provide the name of the taxpayer as it appears on your tax return, along with the Social Security Number or Employer ID Number (EIN).

- If applicable, indicate the name of the partnership, S corporation, LLC, or LLP that earned the credit and provide the EIN for that entity.

- In Part A, enter the period for which you were HPIP certified and your HPIP certification number accurately.

- Move to Part B and input the total qualified cash investment in training and education, followed by the total payroll amount expended during the specified period.

- Calculate and input the amounts for lines 5 and 6, ensuring correct arithmetic is applied to derive the training and education credit for the amount invested.

- Enter your proportionate share percentage in line 8 and calculate the amount of credit allowable for training and education in line 9.

- For Part C, fill out the address of the qualified business facility and complete the investment schedule from lines 11a to 11m according to the detailed instructions provided.

- Continue through Parts D and E, entering the number of jobs created, payroll, and additional revenue information as required, and track the credit carry forward schedule.

- Review all entered information for accuracy and completeness, then save changes to your form.

- Finally, you may download, print, or share the form as necessary.

Complete your KS K-59 form online today for a seamless filing experience.

The credit is limited to the taxpayer's tax liability. For qualified business facility investment placed into service in taxable years commencing after Dec. 31, 2000 for which the amount of tax credit exceeds the tax liability in any one taxable year, the excess amount may be carried forward for a period of 16 years.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.