Loading

Get Ms Dor 80-105 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MS DoR 80-105 online

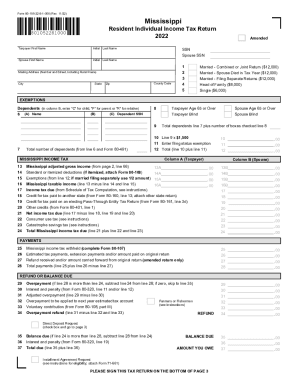

Filling out the MS DoR 80-105 form online is a straightforward process that enables residents to submit their individual income tax return efficiently. This guide provides step-by-step instructions to assist users in accurately completing the form.

Follow the steps to complete your online income tax return.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the taxpayer's first name, initial, and last name in the designated fields. If applicable, also enter the spouse's first name, initial, and last name.

- Indicate whether the return is amended by checking the corresponding box.

- Input the Social Security numbers (SSNs) for both the taxpayer and spouse in the appropriate fields.

- Fill in the mailing address, including the number and street, city, state, zip code, and county code.

- Select your filing status by checking one of the options: married filing jointly, married filing separately, head of household, or single.

- In the exemptions section, enter information for dependents. For each dependent, enter their name and SSN while marking the relationship in column B.

- Calculate your total number of dependents and any exemptions applicable based on age or blindness.

- Transfer your Mississippi adjusted gross income from page 2, line 66 to the appropriate field on page 1.

- Specify your standard or itemized deductions, attaching Form 80-108 if itemized.

- Compute your Mississippi taxable income by subtracting deductions and exemptions from your adjusted gross income.

- Complete the section regarding income tax due, credits, payments, and any refunds or balances due.

- If choosing direct deposit for refunds, provide necessary bank account details.

- Finally, sign the form and provide the date, along with any preparer's information if applicable.

- Once all fields are filled, save changes, download a copy, print for your records, or share the form as needed.

Start filling out your MS DoR 80-105 form online today for a hassle-free tax filing experience.

You should file a Mississippi Income Tax Return if any of the following statements apply to you: You have Mississippi income tax withheld from your wages (other than Mississippi gambling income). You are a non-resident or part-year resident with income taxed by Mississippi (other than gambling income).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.