Loading

Get Mo W-3 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO W-3 online

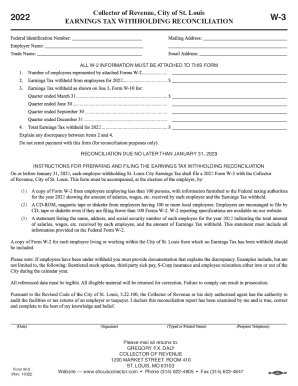

The MO W-3 is the earnings tax withholding reconciliation form used by the City of St. Louis. This guide will provide you with a clear and comprehensive overview of how to accurately complete this form online.

Follow the steps to successfully fill out the MO W-3 form.

- Click ‘Get Form’ button to obtain the form and open it in your document management system.

- Begin by entering the total earnings paid to your employees as noted on W-2 forms. Ensure that this amount matches the total from all attached W-2 forms.

- Next, provide the total tax withheld for city earnings tax as reported on those W-2 forms. Be diligent in checking the accuracy of this figure.

- In the designated areas, include any additional relevant notes or adjustments that may pertain to the tax reconciliation process.

- Once all fields are completed, review the entire form to ensure accuracy and completeness. It's important to double-check all figures against your records.

- After finalizing your entries, save any changes made to your form. You may also choose to download, print, or share the completed document for your records.

Complete your documents online today for a streamlined filing process.

The difference between Form W-2 and Form W-3 is the person(s) who complete the forms. Employees are required to complete Form W-2 while employers are responsible for completing Form W-3. Employers must file both W-2 and W-3 forms with the Social Security Administration by January 31 of every year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.