Loading

Get Nyc Dof Att-s-corp 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NYC DoF ATT-S-CORP online

This guide provides a comprehensive overview of filling out the NYC Department of Finance form ATT-S-CORP online. Whether you are a seasoned professional or a first-time filer, this step-by-step approach will help you navigate the required fields with confidence.

Follow the steps to complete the NYC DoF ATT-S-CORP form online:

- Press the ‘Get Form’ button to access the document and open it for editing.

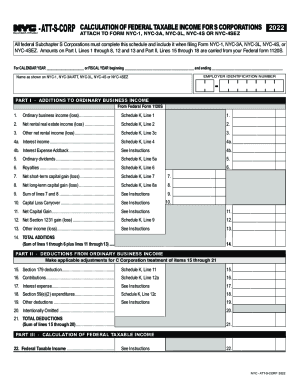

- Enter the calendar year or the fiscal year dates in the appropriate fields at the top of the form.

- Provide the name as shown on your NYC-1, NYC-3A/ATT, NYC-3L, NYC-4S, or NYC-4SEZ in the designated section.

- Input your employer identification number (EIN) accurately in the designated field.

- Begin filling out Part I - Additions to ordinary business income by entering figures from your Federal Form 1120S, specifically from Schedule K, in the corresponding lines.

- Complete all addition lines up to line 14, ensuring to sum the required lines as indicated.

- Move to Part II - Deductions from ordinary business income, and input deductions calculated from the appropriate federal form sections.

- Fill out all deduction lines up to line 21, summing them as required.

- Proceed to Part III for the calculation of federal taxable income; this will involve subtracting total deductions from total additions.

- Review all entered information for accuracy and completeness.

- Once satisfied, save changes, and select the option to download, print, or share your completed form as needed.

Complete your NYC DoF ATT-S-CORP online to ensure proper filing.

Related links form

A business can register as an "S corporation" for filing New York State taxes. The filing allows individual shareholders to report corporate income on their own tax returns. All shareholders must agree to file. Businesses must also be registered as a S corporation with the federal government.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.