Loading

Get Ks Dor Schedule S 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KS DoR Schedule S online

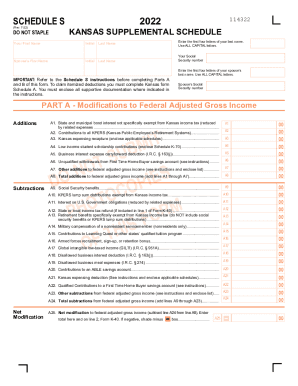

Filling out the Kansas Supplemental Schedule S is a critical step in accurately reporting your income modifications and allocations. This guide will provide you with clear instructions to complete the form online, ensuring that you can navigate each section with confidence.

Follow the steps to complete the KS DoR Schedule S.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Begin by entering your personal information in the designated fields. This includes your first name, middle initial, last name, and the same for your spouse if applicable. Make sure to use ALL CAPITAL letters.

- Enter the first four letters of your last name and your Social Security number, followed by the first four letters of your spouse’s last name and their Social Security number.

- Proceed to Part A, which involves modifications to your federal adjusted gross income. Carefully fill in the additions and subtractions by referencing the instructions for each line item.

- For each addition or subtraction, ensure you include any necessary supporting documentation as specified in the form's instructions.

- Calculate the total additions and subtractions by following the provided instructions, entering those totals in the appropriate fields.

- Once Part A is complete, move on to Part B, which focuses on income allocation for nonresidents and part-year residents. Fill in the respective income figures in the corresponding fields.

- Complete the calculations for income from Kansas sources and determine your nonresident allocation percentage by following the instructions on the form.

- Review all the entered information for accuracy and completeness. Make any necessary changes before final submission.

- Once you are satisfied with the information entered, save your changes, and select the option to download, print, or share the form as needed.

Start completing your KS DoR Schedule S online now for a simplified filing process.

States are free to provide exemptions to state and local governments. Not all states provide an exemption for sales to themselves. Government contractors may also qualify for exemptions. States are free to choose whether to tax non-profit organizations and charitable organizations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.