Loading

Get Mo Mo-ptc 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO MO-PTC online

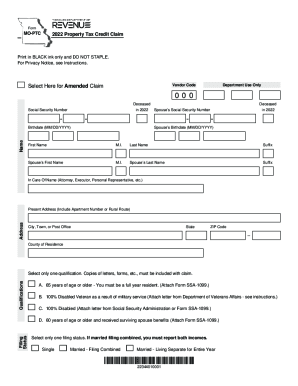

Navigating the MO MO-PTC form can be challenging, but this guide is designed to support you through each step of the process. By following these instructions, you will be able to fill out the 2022 Property Tax Credit Claim accurately and efficiently.

Follow the steps to complete your Property Tax Credit Claim

- Press the ‘Get Form’ button to obtain the MO MO-PTC online, allowing you to access the form in your preferred digital format.

- Begin filling out the form by entering your Social Security number in the designated field. Ensure the number is accurate to prevent delays in processing.

- Provide your birthdate in the format MM/DD/YYYY. This is essential for verifying eligibility criteria.

- Enter your full name, including any middle initials or suffixes. If applicable, also include your spouse’s details, following the same structure.

- Specify your current address, including any apartment number or rural route information, followed by your city, state, and ZIP code.

- Indicate your county of residence. This information is vital for proper processing of your claim.

- Select one qualification option that applies to you. Attach required documentation to support your claim.

- Choose your filing status from the available options. Ensure that both incomes are reported if married and filing combined.

- Enter the amount of social security benefits received. Attach Form SSA-1099 to validate this amount.

- Include the total of other income types you have received alongside your spouse and minor children, and attach the appropriate forms.

- Calculate your total household income and enter it on the form, following the provided guidelines.

- If applicable, fill out the sections regarding property taxes paid or rent verification. Ensure all attachments required for claims are included.

- Once you have filled out the form completely, review all entries for accuracy. You may then save changes, download, print, or share the document as needed.

Complete your Property Tax Credit Claim online today for a smooth filing experience.

For Homeowners. To be eligible, a person who owns their home must occupy it for the entire year, and have an income of: $30,000 or less for a single person. $34,000 or less for a household.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.