Loading

Get Mo Dor 149 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO DoR 149 online

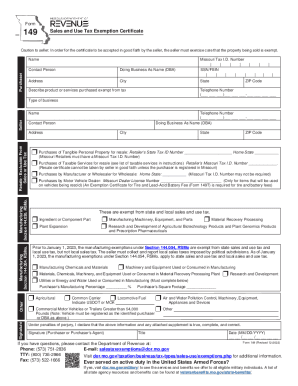

The MO DoR 149 is the Sales and Use Tax Exemption Certificate used in Missouri, allowing qualified purchasers to claim exemption from sales and use tax. This guide provides detailed instructions on how to complete the form online, ensuring that users understand each component and requirement clearly.

Follow the steps to fill out the MO DoR 149 online effectively.

- Click ‘Get Form’ button to obtain the form and access it in your preferred online editor.

- Enter the purchaser's name along with the contact person's details and the Doing Business As (DBA) name.

- Fill in the purchaser's address, city, state, and ZIP Code, ensuring all information is accurate.

- Input the Missouri Tax I.D. Number or Social Security Number/Federal Employer Identification Number (SSN/FEIN) as required.

- Provide details about the product or services being purchased exempt from tax.

- Specify the type of business related to the exemption under the seller’s section.

- Complete the seller's name and contact details, including their DBA and telephone number.

- Select the appropriate exempt purchase type from the list provided (tangible personal property for resale, manufacturing, etc.) and fill out any additional necessary information.

- If applicable, complete sections related to utility or energy use for manufacturing and include the relevant account numbers.

- Review all entries to ensure accuracy and completeness. Once finished, you may save changes, download, print, or share the filled form as needed.

Start filling out the MO DoR 149 online today to benefit from your tax exemptions.

How to Claim the Missouri Sales Tax Exemption for Agriculture. In order to claim the Missouri sales tax exemption for agriculture, qualifying agricultural producers must fully complete a Missouri Form 149 Sales and Use Tax Exemption Certificate and furnish this completed form to their sellers.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.