Loading

Get Mo Dor Form 126 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO DOR Form 126 online

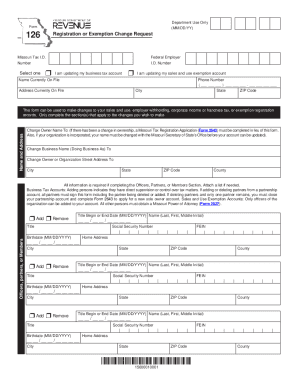

Filling out the MO DOR Form 126 online can be a straightforward process with the right guidance. This form is used for registration or exemption change requests in Missouri, and understanding each section is essential to ensure accurate completion.

Follow the steps to fill out the MO DOR Form 126 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Select whether you are updating your business tax account or your sales and use exemption account by checking the appropriate box.

- Provide your current name on file, along with your phone number and address. Ensure all information is completed accurately.

- If applicable, indicate any changes to ownership or business name by filling in the new details in the designated sections.

- Fill out the Officers, Partners, or Members section with necessary information about new or removed individuals. Remember, all partners must sign if there are changes.

- Complete the Authorized Representatives Section to identify individuals who have supervision over tax matters, providing their names, titles, and other required information.

- If there are changes to your business location, provide the new addresses and specify if the business is located within a city or municipality.

- Select any applicable tax types and provide details for changes in filing frequency if relevant.

- Include any comments as necessary, and finally ensure you sign, print your name, and date the form at the bottom.

- Once completed, you can save changes, download, print, or share the form as needed.

Take the next step and fill out your MO DOR Form 126 online today.

All sales of tangible personal property and taxable services are generally presumed taxable unless specifically exempted by law. Persons making retail sales collect the sales tax from the purchaser and remit the tax to the Department of Revenue. The state sales tax rate is 4.225%.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.