Loading

Get Mn Dor M1pr 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MN DoR M1PR online

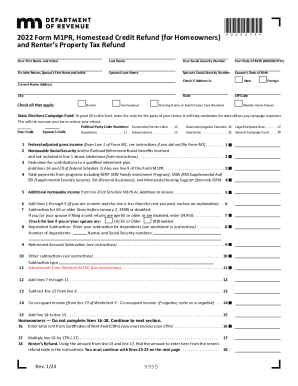

This guide provides clear instructions on how to complete the MN DoR M1PR, a crucial form for claiming property tax refunds for homeowners and renters in Minnesota. Follow these steps to ensure a smooth online filing process.

Follow the steps to complete your MN DoR M1PR online

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Enter your first name, middle initial, and last name in the designated fields. Make sure all names match your official documents.

- Provide your Social Security number accurately to avoid any issues with processing.

- Fill in your date of birth in the format MM/DD/YYYY. If filing jointly, repeat this step for your spouse's information.

- Indicate your current home address and check whether it is a new address or if you are a mobile home owner, homeowner, renter, etc.

- If applicable, select whether you wish to contribute $5 to the State Elections Campaign Fund by entering the code for your chosen party.

- Input your federal adjusted gross income as required, ensuring accuracy and completeness based on your tax filings.

- Report any nontaxable Social Security or Railroad Retirement benefits received that are not included in line 1.

- Provide any other necessary deductions and payments from relevant programs, using the specific line numbers indicated on the form.

- Complete any additional fields required for deductions, such as those for dependents, age, or disability status.

- Review all your entries for completeness and correctness, particularly your calculations for income and deductions.

- Once all sections are filled out, you can save your changes, download, print, or share the form as required.

Start filling out your MN DoR M1PR online now to ensure you receive your property tax refund promptly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.