Loading

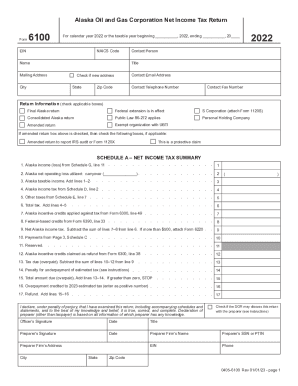

Get Ak Form 6100 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AK Form 6100 online

Completing the AK Form 6100 online is an essential process for Alaska businesses to report their net income tax. This guide aims to provide clear, step-by-step instructions that will help users navigate through each section of the form effectively.

Follow the steps to successfully complete the AK Form 6100 online.

- Click the ‘Get Form’ button to acquire the form and open it for editing.

- Begin by entering the necessary identifying information, including your Employer Identification Number (EIN) and the North American Industry Classification System (NAICS) code.

- Fill in the contact person's details, such as their name, title, and mailing address. Be sure to check any box indicating a new address if applicable.

- In the return information section, check the appropriate boxes corresponding to your situation, including options for final returns, S Corporations, and amended returns if necessary.

- Proceed to Schedule A, where you will detail your net income tax summary, including Alaska income and losses, and calculate your taxable income.

- Continue to Schedule B to provide taxpayer information and include details of any corporations with nexus in Alaska.

- Complete Schedule C, documenting estimated payments and any other relevant tax payment records.

- Fill out Schedule D for tax computation, using the Tax Rate Table as reference for calculating your tax liability.

- Follow with Schedule E where you will input any additional taxes that may apply to your return.

- Complete Schedule G to compute Alaska income, providing necessary adjustments and calculations.

- Next, go through Schedule I for apportionment factors and ensure all necessary entries are made based on the operations of your business.

- Finish by filling out any additional schedules relevant to your situation, such as Schedules J, K, and L, where you will document capital gains/losses and charitable deductions.

- Before final submission, review all sections for accuracy. Save your changes, then proceed to download, print, or share the completed form as needed.

Take action today and complete the AK Form 6100 online for efficient document management.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.