Loading

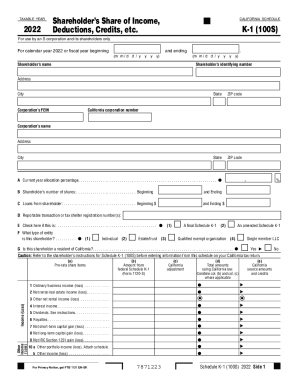

Get Ca Ftb 100s Schedule K-1 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 100S Schedule K-1 online

The CA FTB 100S Schedule K-1 is a crucial document for shareholders of S corporations in California. This guide provides clear and supportive instructions on how to complete the form online, ensuring that you gather all necessary information to fulfill your tax obligations.

Follow the steps to complete the CA FTB 100S Schedule K-1 with ease.

- Click ‘Get Form’ button to obtain the CA FTB 100S Schedule K-1 and open it in the online editor.

- Fill in the shareholder’s name and identifying number in the designated fields. Ensure that the information matches your tax records.

- Enter the corporation’s name, address, and federal employer identification number (FEIN) provided by the corporation.

- Indicate the current year allocation percentage, as well as the number of shares the shareholder held at both the beginning and the end of the year.

- Provide details of any loans from the shareholder, including the beginning and ending balances, and the percentage of the loan.

- Select the type of entity for the shareholder from the options provided, ensuring to mark whether they are an individual, estate, trust, qualified exempt organization, or single member LLC.

- Indicate residency status in California by selecting 'Yes' or 'No'.

- Complete the financial items section, which includes ordinary business income (loss), rental income, interest income, dividends, and various other income sources. Ensure to input amounts as per the federal Schedule K-1.

- Document any adjustments related to California state law in the corresponding section, ensuring all entries align with federal form totals, adjusted for California law.

- Review the Other Information section for any additional credits, deductions, or information requirements that apply to the shareholder.

- After completing the form, save your changes, then download, print, or share the completed Schedule K-1 as needed.

Complete the CA FTB 100S Schedule K-1 online to efficiently manage your tax filings.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.