Loading

Get Ca Ftb 3596 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 3596 online

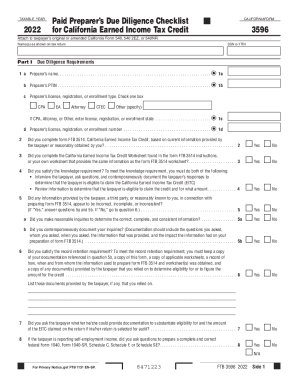

The CA FTB 3596 is a critical form for ensuring compliance with due diligence requirements for the California Earned Income Tax Credit. This guide offers step-by-step instructions to help users navigate the process of completing this form online effectively.

Follow the steps to complete the CA FTB 3596 with confidence.

- Click ‘Get Form’ button to access the CA FTB 3596 online and open it in your preferred editor.

- Begin by entering the taxpayer's name(s) as shown on the tax return, followed by the Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) in the designated fields.

- In Part I, fill out the preparer's name and PTIN (Preparer Tax Identification Number). Then, select the preparer’s license, registration, or enrollment type by checking the corresponding box.

- Complete question 2 by indicating whether you have filled out Form FTB 3514 based on the taxpayer’s information. Choose 'Yes' or 'No' as applicable.

- For questions 3 and 4, ensure that you document responses accurately to confirm that you completed the California Earned Income Tax Credit Worksheet and that the knowledge requirement is satisfied.

- Proceed to questions 5 and 6 to verify if all information used was correct and to document any inquiries made regarding potential discrepancies.

- Continue through Parts II and III, addressing questions about eligibility and compliance with record retention requirements. Complete any additional disclosures required.

- Once you have filled in all necessary information and verified its accuracy, you can save changes, download, print, or share the completed form as needed.

Complete your documents online to ensure a smooth filing process.

You may qualify for CalEITC if: You're at least 18 years old or have a qualifying child. You have earned income within certain limits.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.