Loading

Get Ny It-641 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY IT-641 online

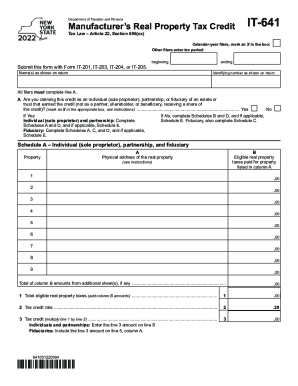

Filling out the NY IT-641 form can be a straightforward process when you understand each section and its requirements. This guide provides a clear, step-by-step approach to help you complete the form accurately and efficiently.

Follow the steps to complete your NY IT-641 form online.

- Click ‘Get Form’ button to obtain the form and open it in the chosen editor for online completion.

- Indicate your filing status by marking the appropriate box: check the box for calendar-year filers or enter your tax period if you are filing for another period.

- Complete the personal details section by entering your name(s) as they appear on your tax return and your identifying number.

- On line A, specify if you are claiming the credit as an individual, partnership, or fiduciary by marking the corresponding box. If you answer 'yes,' complete Schedules A and D; if 'no,' complete Schedules B and D.

- If applicable, fill in Schedule A by providing the physical address of the real property and eligible real property taxes paid. Sum the amounts in column B.

- On Schedule D, calculate your total credit by adding relevant lines from Schedules A, B, and possibly C. Make sure to transfer these amounts correctly to the designated sections.

- Complete Schedule E for computation of credit recapture, entering the required figures appropriately. Ensure that totals are accurately carried over to the final sections.

- Review all filled sections for accuracy. Once satisfied, you can save any changes made to the form, download it for your records, print it out, or share it as needed.

Complete your NY IT-641 form online today for an efficient filing experience.

Related links form

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.