Loading

Get Ok Otc 512e 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OK OTC 512E online

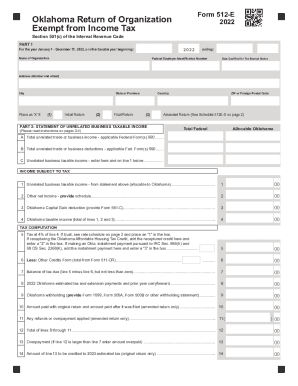

Filling out the OK OTC 512E form is an essential step for organizations seeking to assert their tax-exempt status in Oklahoma. This guide provides straightforward instructions for completing the form accurately, ensuring compliance and ease in managing your digital documents.

Follow the steps to complete the OK OTC 512E online.

- Press the ‘Get Form’ button to access the OK OTC 512E form and open it in your preferred editing tool.

- Fill in the basic information required in Part 1, which includes the name of your organization, its Federal Employer Identification Number (FEIN), and the address. Ensure that all information is accurate and reflects current data.

- Indicate if this is your initial return, final return, or an amended return by marking the relevant checkboxes provided in the upper section of the form.

- Complete Part 2 by detailing any unrelated business taxable income (UBTI) if applicable. Enter the total unrelated business income and deductions, eventually leading to the computation of the unrelated business taxable income which must be reported.

- Follow through the tax computation section, where you will calculate the Oklahoma taxable income. Make sure to account for any deductions or credits, as necessary, and pay special attention to the requirements for trusts.

- If applicable, choose to make a donation from your tax refund towards approved Oklahoma organizations and explicitly list the amount and organization number to facilitate processing.

- Fill out the direct deposit section carefully to ensure any refunds are directly deposited into your designated account. Double-check your routing and account numbers for accuracy.

- Finalize your form by providing all required signatures and dates in the designated areas for the office or trustee, as well as the preparer if applicable.

- Once completed, review the form for any errors before saving, downloading, and, if necessary, printing it for submission or sharing with relevant parties.

Complete the OK OTC 512E form online today to ensure your organization maintains its tax-exempt status in Oklahoma.

Underpayment of estimated tax occurs when you don't pay enough tax during those quarterly estimated tax payments. Failure to pay proper estimated tax throughout the year might result in a penalty for underpayment of estimated tax. The IRS does this to promote on-time and accurate estimated tax payments from taxpayers.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.