Loading

Get Ny It-256 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY IT-256 online

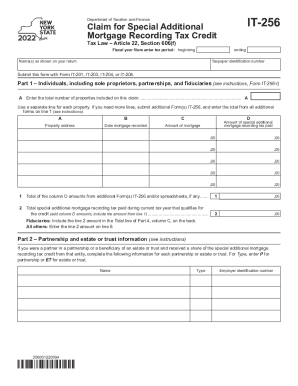

This guide will assist you in completing the NY IT-256 form, which is essential for claiming the special additional mortgage recording tax credit. By following this comprehensive and user-friendly guide, you will ensure that your application is accurate and complete.

Follow the steps to successfully complete the NY IT-256 form online.

- Click ‘Get Form’ button to obtain the form and open it in the digital editor.

- Enter your name(s) as shown on your return and your taxpayer identification number at the beginning of the form.

- In Part 1, indicate the total number of properties included in your claim. Use a separate line for each property and submit additional IT-256 forms if necessary.

- For each property, fill out the property address, the date the mortgage was recorded, the amount of the mortgage, and the special additional mortgage recording tax paid. Ensure that all fields are complete and accurate.

- At the bottom of Part 1, tally the amounts from column D for all properties and enter this total on line 1. Then, calculate the total special additional mortgage recording tax paid during the current tax year and enter this amount on line 2.

- If applicable, complete Part 2 for partnerships or estates or trusts, providing the details for each entity as requested, including the employer identification number.

- In Part 3, enter your share of the credit from the partnership or estate or trust. Complete the necessary calculations and ensure they align with your figures.

- Part 4 requires you to provide the beneficiary's name and identifying number, along with the share of the special additional mortgage recording tax. Fill this information accurately.

- In Part 5, compute the credit available for the current tax year by following the instructions and summing the appropriate figures from previous parts.

- In Part 6, enter the necessary figures to compute the credit used, any refund amounts, and the leftover credit you wish to carry forward. Follow the instructions carefully to avoid mistakes.

- Once all sections are accurately filled out, review your entries for completeness and accuracy. Save your changes, and proceed to download, print, or share the completed form as needed.

Begin completing your NY IT-256 online today to ensure you take advantage of available tax credits.

In NYC, the buyer pays a mortgage recording tax rate of 1.8% if the loan is less than $500,000 and 1.925% if more than $500,000 or more. Buyers of commercial property pay 2.55%. These rates are what the buyer is responsible for. Your mortgage lender will also contribute 0.25%.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.