Loading

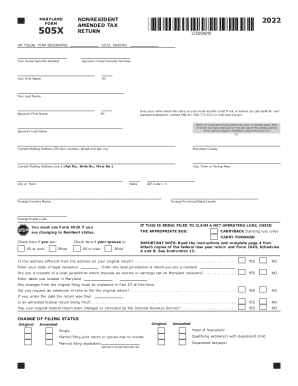

Get Md Comptroller 505x 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MD Comptroller 505X online

The MD Comptroller 505X form is used for filing a nonresident amended tax return in Maryland. Completing this form online can help ensure accuracy and efficiency in your tax filing process.

Follow the steps to fill out the MD Comptroller 505X form online.

- Press the ‘Get Form’ button to access the MD Comptroller 505X form and open it in your browser.

- Fill out your personal details at the top of the form, including your Social Security number, name, and current mailing address. Ensure that the information matches the records from your Social Security card.

- Indicate if you are claiming a net operating loss by checking the appropriate box. Provide details about any changes in your filing status since your original return.

- Proceed to Section I, which covers income and adjustments. Enter the necessary figures from your federal tax return as well as your Maryland income, and indicate any changes from your original return.

- Move to Section II to detail your itemized deductions if applicable, ensuring all adjustments are accurately calculated.

- In Section III, explain any changes made on this amended return. Be thorough while providing the reason for each amendment, and attach any supporting documents if required.

- Review all entered information for accuracy. Ensure both you and your spouse (if applicable) sign the form. Check that all necessary documents are attached.

- Finally, save your changes, download the completed form if needed, and prepare to submit it online according to the provided instructions.

Complete your tax documents online for a smooth filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

You must file your Maryland Amended Form 502X electronically to claim, or change information related to, business income tax credits from Form 500CR. Changes made as part of an amended return are subject to audit for up to three years from the date that the amended return is filed.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.