Loading

Get Ny Dtf It-201-x-i 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DTF IT-201-X-I online

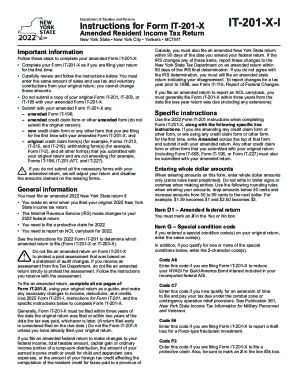

Filling out the NY DTF IT-201-X-I form can seem daunting, but with a clear guide, you can navigate the process smoothly. This comprehensive guide is designed to help you complete your amended resident income tax return effectively and efficiently, ensuring you meet all necessary requirements.

Follow the steps to accurately complete the NY DTF IT-201-X-I online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your personal information as required at the top of the form, including your name and address.

- Mark an X in the 'Yes' or 'No' box for Item D1 to indicate if you are filing an amended federal return.

- For Item G, enter any special condition codes from your original return, or provide new codes if applicable.

- Complete line 34 by entering either the standard deduction or itemized deduction amount, following appropriate calculations based on your situation.

- Input the amount of sales or use tax from your original return on line 59; remember this amount cannot change.

- Enter the total of your voluntary contributions from the original return on line 60.

- Fill out line 76 with the amount paid with the original return and any additional amounts paid since.

- Determine your overpayment, if any, to report on line 78, corresponding to your original return.

- Decide on your refund method—either direct deposit or paper check—and complete the relevant lines.

- If you owe tax, calculate and enter this amount on line 81.

- Review all entries for accuracy, ensuring you have included any supporting documents as stated in the instructions.

- Once satisfied with your form, save your changes, download a copy for your records, and either print the form for mailing or use the appropriate online submission method.

Complete your documents online today for a hassle-free filing experience.

The IT-201 is the main income tax form for New York State residents. It is analogous to the US Form 1040, but it is four pages long, instead of two pages. The first page of IT-201 is mostly a recap of information that flows directly from the federal tax forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.