Loading

Get Md Comptroller 515 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MD Comptroller 515 online

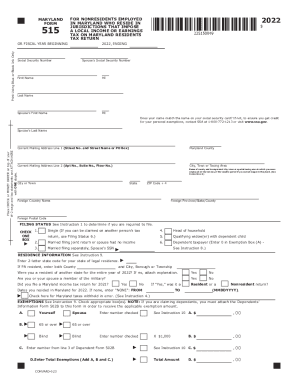

Filling out the MD Comptroller 515 form is an essential step for nonresidents employed in Maryland who reside in jurisdictions with local income or earnings tax. This guide aims to provide clear, step-by-step instructions to help users complete the form accurately and easily.

Follow the steps to successfully complete the MD Comptroller 515 form.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Fill in your personal information, including your social security number and your spouse's social security number if applicable. Ensure that the name matches the name on your social security card.

- Provide your current mailing address, ensuring to include the street address, city, state, and ZIP code. If residing in a foreign country, also provide the foreign province or state and postal code.

- Select your filing status by checking the appropriate box on the form. Refer to the instructions for guidance on which status to choose.

- Complete the residence information section by entering your state of legal residence and related details, including military status if applicable.

- Move to the exemptions section. Check the appropriate boxes to claim exemptions for yourself, your spouse, or any dependents.

- Next, complete the income and adjustments information by entering all relevant figures from your federal income return and Maryland wage income.

- Finalize the form by reviewing all sections for accuracy. Once completed, you can save changes, download, print, or share the form as necessary.

Complete your MD Comptroller 515 form online to ensure a smooth filing process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

If you have not paid your taxes due in full, or have not filed a Maryland return that we believe you should have, you will receive an income tax notice from the Comptroller of Maryland. If you do not respond to the first notice, an assessment notice will be issued.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.