Loading

Get Ny It-201-i 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY IT-201-I online

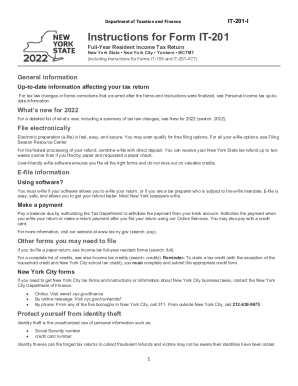

Filling out the NY IT-201-I form online can streamline the tax filing process as a full-year resident of New York. This comprehensive guide will provide step-by-step instructions and tips to ensure accurate completion of the form, maximizing your potential deductions and credits.

Follow the steps to successfully complete your NY IT-201-I form online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your personal information including your name, mailing address, Social Security number, and date of birth in the designated fields. Ensure that the information entered matches your identification documents.

- Select your filing status from the options provided, making sure to review the specific conditions that apply to your situation.

- Fill in your income information based on your federal tax return. This includes total wages, salaries, tips, and other relevant income.

- Complete the New York additions and subtractions as necessary. This section may adjust your federal adjusted gross income based on specific New York tax laws.

- Determine whether to take the standard deduction or itemized deductions. Choose the option that provides the maximum benefit for your tax situation.

- Calculate your New York State tax based on your taxable income and applicable tax rates. This section is crucial for determining your overall tax liability.

- Review any credits for which you may qualify, including the Empire State child credit, child and dependent care credits, and others as applicable.

- Confirm your estimated tax payments and any withholding amounts from your W-2 forms. Accurate reporting will ensure proper calculation of any owed taxes or potential refunds.

- Complete the sign and date section, making sure both spouses sign if applicable. Review your entire form for accuracy before submission.

- Save your changes, download a copy of your completed form, and follow the instructions provided for submitting it electronically.

Complete your forms online today to benefit from quicker processing times and to ensure your tax return is filed accurately.

Nonresidents of New York City are not liable for New York City personal income tax. The rules regarding New York City domicile are also the same as for New York State domicile.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.