Loading

Get Ny Dtf It-280 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DTF IT-280 online

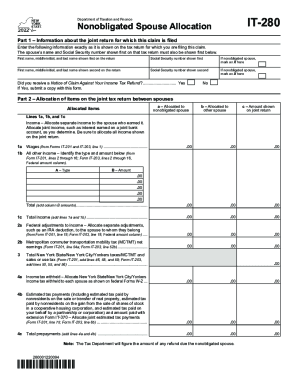

This guide provides detailed instructions on how to complete the NY DTF IT-280 form online. By following these steps, you will efficiently fill out the necessary information to allocate your tax responsibilities as a nonobligated spouse.

Follow the steps to successfully complete the NY DTF IT-280 online.

- Press the ‘Get Form’ button to obtain the form and access it in your preferred online editor.

- In Part 1, fill in your information exactly as it appears on the original tax return. Start with the first spouse's full name and Social Security number, ensuring they are entered in the correct order. If you are the nonobligated spouse, mark the appropriate box.

- Continue in Part 1 to input the second spouse's name and Social Security number, marking the nonobligated spouse box if applicable. Indicate whether you have received a Notice of Claim Against Your Income Tax Refund and submit a copy if necessary.

- Proceed to Part 2, where you will allocate items from the joint tax return. For each line item, specify which spouse the income or adjustment is allocated to in the appropriate columns, ensuring all income is accurately captured.

- After completing the allocations, add the amounts in the relevant sections, including total income and any federal adjustments to income. Make sure all calculations are correct.

- In Part 3, sign and date the form in the designated area. Both spouses must sign, including any paid preparer if applicable.

- Finally, save your changes, and you may choose to download, print, or share the completed form as required.

Take the next step and complete your documents online to ensure efficient filing.

If HMRC think you have overpaid tax, they will send you a repayment of tax automatically – you do not need to make a claim. If HMRC think you have not paid enough tax, they will write to you explaining that they intend to collect the underpaid tax through your tax code or telling you how you can repay it to them.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.