Loading

Get Ny Dtf It-201-att 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DTF IT-201-ATT online

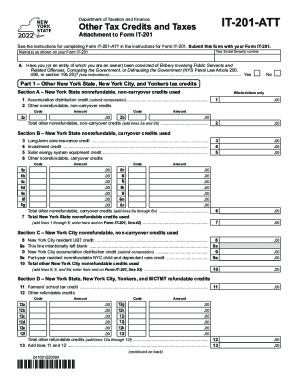

The NY DTF IT-201-ATT is an essential form used in conjunction with Form IT-201 for declaring other tax credits and taxes in New York. Completing this form accurately is crucial for ensuring you receive all entitled tax benefits.

Follow the steps to fill out the NY DTF IT-201-ATT online effectively.

- Click ‘Get Form’ button to access the NY DTF IT-201-ATT and open it in your preferred digital editor.

- Enter your name(s) as shown on your Form IT-201 in the designated field.

- Input your Social Security number in the required section.

- Respond to the question regarding any convictions related to bribery or defrauding the government by selecting 'Yes' or 'No'.

- In Part 1, Section A, record any New York State nonrefundable, non-carryover credits used by entering amounts in whole dollars only.

- Move to Section B and enter the New York State nonrefundable, carryover credits used, also in whole dollar amounts.

- Complete Section C for any New York City nonrefundable, non-carryover credits used.

- Fill out Section D regarding refundable credits, ensuring you add any relevant values accurately.

- Proceed to Part 2 for other New York State taxes, where you will submit any applicable forms and enter amounts as needed.

- Finally, after reviewing all sections, save your changes, download the completed form, and print or share it as required.

Complete the NY DTF IT-201-ATT online now to ensure you claim all your tax credits.

If enclosing a payment (check or money order), mail your NYS income tax return to: STATE PROCESSING CENTER. PO BOX 15555. ALBANY, NY 12212-5555.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.