Loading

Get Md Comptroller 502 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MD Comptroller 502 online

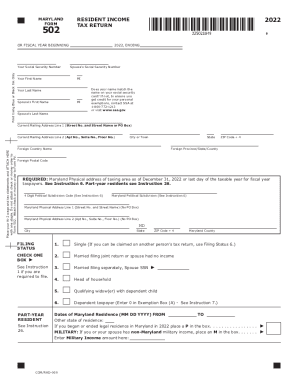

The MD Comptroller 502 is a critical document for Maryland residents filing their income tax return. This guide provides clear, step-by-step instructions to assist you in completing the form accurately and efficiently.

Follow the steps to fill out your MD Comptroller 502 online.

- Press the ‘Get Form’ button to access the MD Comptroller 502 and open it in your preferred editing tool.

- Begin by entering your Social Security Number (SSN) in the designated field to identify your tax return accurately.

- Input your personal information including first name, middle initial (if applicable), and last name, ensuring it matches your Social Security card.

- Complete the section for your spouse if applicable, including their SSN and full name. Verify that the names match their respective Social Security cards.

- Fill in your current mailing address, ensuring to separate the street address into the appropriate fields. Include the city, state, and ZIP Code + 4.

- Provide your Maryland physical address as of December 31, 2022. This address must not be a P.O. Box and should include the relevant street details.

- Indicate your filing status by selecting the box that corresponds to your situation, such as single, married filing jointly, or head of household.

- If you are a part-year resident, enter the dates of your Maryland residence in the specified format.

- Specify the type of income you received and fill in the relevant fields under ''Income'' with accurate figures from your federal return.

- While filling in exemptions, accurately check boxes for yourself, your spouse, and dependents, before calculating the total exemptions.

- Follow the instructions provided to calculate any additions or subtractions to your Maryland income accurately.

- Complete all calculations leading to your total Maryland taxable income by following the layout of the form diligently.

- At the end of the form, review and ensure all sections are completed accurately. You can then save any changes, download the completed form, print it for your records, or share it if necessary.

Complete your MD Comptroller 502 online to ensure proper filing and avoid any future issues.

The IRS can levy, seize and sell any type of personal property that you own or have an interest in, such as your car, or real estate, and apply that money to your unpaid tax bill. IRS. What is a Levy?. On top of all that, the State Department may not issue or renew your passport, and it might even revoke it.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.