Loading

Get De Dor 1100s 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DE DoR 1100S online

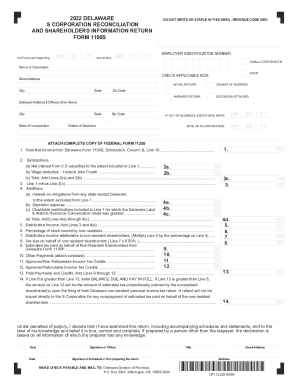

This guide provides users with a clear and supportive approach to completing the DE DoR 1100S, the Delaware S Corporation Reconciliation and Shareholders Information Return form, online. Following these steps will help ensure accurate and timely submission of your form.

Follow the steps to complete the DE DoR 1100S form online.

- Press the ‘Get Form’ button to access the DE DoR 1100S form and open it in your preferred editor.

- Begin by entering the employer identification number at the top of the form.

- Provide the name of the corporation in the designated field.

- Indicate if the corporation is a small corporation by checking the appropriate box.

- Fill in the street address, city, state, and zip code where the corporation is located.

- If the corporation has a different Delaware address, include that information in the specified fields.

- Select the applicable option regarding the status of the return, whether it is the initial return, change of address, amended return, or if an extension is attached.

- Supply the state of incorporation and date of incorporation in the respective fields.

- If the corporation is out of business, enter the date in the provided space.

- Describe the nature of the business briefly.

- Refer to Schedule A and enter total net income on Line 1.

- For Line 2, make the necessary subtractions by providing net interest from U.S. securities and wage deductions as appropriate.

- Calculate Line 3 by subtracting the total from Line 2c from Line 1.

- List all required additions for Line 4 and subtotal them as indicated.

- Calculate distributive income on Line 5 by adding Line 3 and Line 4d.

- Complete Lines 6 through 14, following instructions regarding non-resident shareholders and taxes due.

- Finally, review the form for accuracy, then save your changes, download a copy, print it, or share as needed.

Get started and complete your DE DoR 1100S form online today!

Delaware Form 1100S and its schedules is an information return used to reconcile Federal ordinary income to Delaware distributive income and to pay any additional tax due on behalf of non-resident shareholders for the calendar year 2021 or fiscal year beginning in 2021 and ending in 2022.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.