Loading

Get Or Or-20 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the OR OR-20 online

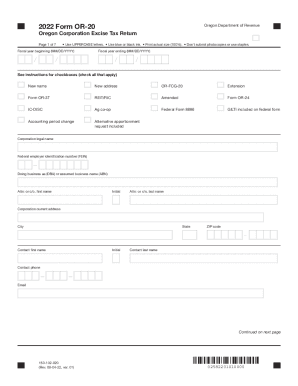

Filling out the OR OR-20 is a crucial step for corporations to report their excise tax in Oregon. This guide provides you with detailed, step-by-step instructions to ensure you complete the form accurately and efficiently.

Follow the steps to successfully complete the OR OR-20 online.

- Click ‘Get Form’ button to obtain the OR OR-20 form and open it in your preferred document editor.

- Enter the fiscal year beginning and ending dates in the designated fields using the MM/DD/YYYY format.

- Check all applicable boxes that best describe your corporation's situation, including options like New name, New address, and Amended, among others.

- Fill in the corporation's legal name and Federal employer identification number (FEIN) in the required fields.

- Provide the Doing business as (DBA) name and the corporation's current address including state, city, and ZIP code.

- If applicable, complete questions A through C if this is your first return or if any relevant information has changed during this tax year.

- Report financial information such as total Oregon sales and taxable income from your U.S. corporation income tax return in the respective fields.

- Follow the prompts to calculate additions, subtractions, and the final taxable income as specified in the instructions, ensuring accuracy in all calculations.

- Apply any credits and deductions outlined in the form, ensuring you include any necessary schedules for details.

- Review all entries for accuracy before finalizing your submission; incorrect information can lead to delays or penalties.

- Once completed, save your changes, and then download, print, or share the form as needed before submission.

Ensure your business remains compliant by completing the OR OR-20 online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

You are a full-year Oregon resident. Your gross income is more than what is defined in this chart. You are a part-year Oregon resident....Part-year and nonresident. Your filing status isAnd your Oregon gross income is more thanSingle$2,420Married filing jointly$4,8404 more rows

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.