Loading

Get Ri Ri-1040nr - Schedule Ii 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the RI RI-1040NR - Schedule II online

This guide provides clear instructions on how to complete the RI RI-1040NR - Schedule II form online. Whether you are a seasoned taxpayer or new to the process, this step-by-step approach will help you navigate the form with ease.

Follow the steps to successfully complete your tax form.

- Press the ‘Get Form’ button to obtain the form and open it for editing.

- Enter your name(s) as shown on Form RI-1040NR and include your social security number at the top of the form.

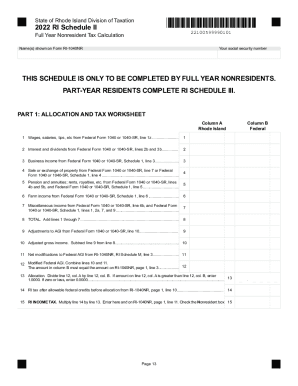

- Complete Part 1: Allocation and Tax Worksheet. Fill in the required fields from Federal Form 1040 or 1040-SR. Start with wages and salaries, and continue through income sources until you reach the total on line 8. Make adjustments for AGI as necessary.

- Calculate your adjusted gross income in Column B by subtracting line 9 from line 8. Fill in any net modifications to Federal AGI, and calculate your modified Federal AGI on line 12.

- In line 13, determine your allocation by dividing the amount in Column A (line 12) by the amount in Column B. If Column A exceeds Column B, enter 1.0000; if it is zero or less, enter 0.0000.

- Fill out line 14 with your Rhode Island tax after allowable federal credits. Then, multiply this amount by the allocation amount in line 13 to get your Rhode Island income tax on line 15.

- Proceed to Part 2 if applicable. Here, calculate the allocation of wage and salary income to Rhode Island, using the provided fields to track days worked in and outside the state.

- Complete Part 3: Business Allocation Percentage by entering the values for property and wages as per the instructions. Aggregate the percentages in column C.

- For incomes and losses that need to be allocated, refer to each line number on RI-1040NR, Schedule II. Multiply your business income amounts according to the percentages calculated earlier and enter them in the corresponding fields.

- Once all sections are filled, review your entries for accuracy. You can then save changes, download the completed form, print it for your records, or share it as needed.

Complete your RI RI-1040NR - Schedule II online quickly and efficiently.

Related links form

Welcome to Free File. You may qualify to prepare and file your federal and Rhode Island resident personal income tax returns online at no charge. ... You may be charged a fee for filing your taxes electronically if you do not meet the qualifications for Free File.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.