Loading

Get Pa Clgs-32-4 2012-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PA CLGS-32-4 online

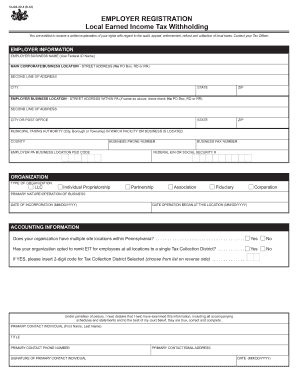

Filling out the PA CLGS-32-4 form online is essential for local earned income tax withholding registration. This guide provides step-by-step instructions to assist users in completing the form accurately and efficiently.

Follow the steps to effectively complete the PA CLGS-32-4 online

- Click ‘Get Form’ button to obtain the PA CLGS-32-4 form and open it in the editor.

- Begin with the employer information section. Enter the employer business name as it appears on the Federal ID. Then, fill in the main corporate/business location including the street address, ensuring to use a valid address (no PO Box, RD, or RR). Complete the second line of the address if necessary, followed by the city, state, and ZIP code.

- If the employer business location within Pennsylvania is different from the main business address, provide that information in the corresponding fields or leave them blank if it is the same.

- Identify the municipal taxing authority where the facility or business is located, along with the county.

- Fill in the business phone number, email address, fax number, and federal employer identification number (EIN) or social security number.

- Select the type of organization from the list provided, including options like LLC, individual proprietorship, corporation, etc.

- Provide the primary nature or operation of the business and the date of incorporation in MM/DD/YYYY format.

- Indicate whether your organization has multiple site locations within Pennsylvania by selecting 'Yes' or 'No.' If applicable, state whether you opted to remit earned income tax for employees at all locations to a single Tax Collection District.

- If applicable, enter the 2-digit code for the Tax Collection District selected.

- The primary contact individual must be filled out, including their first and last name, title, phone number, email address, and the date in MM/DD/YYYY format. Ensure the signature of the primary contact individual is included.

- Once all sections are completed, review the form to ensure accuracy, then save changes, download, print, or share the form as necessary.

Complete your PA CLGS-32-4 form online today!

You have been identified as living in and or working in Pennsylvania. Pennsylvania's Act 32 requires employers to be responsible for withholding local earned income tax from employee paychecks.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.