Loading

Get Cuny Salary Reduction Agreement 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CUNY Salary Reduction Agreement online

This guide provides a step-by-step approach to help users complete the CUNY Salary Reduction Agreement online. By following these instructions, you will ensure that your agreement is correctly submitted and processed.

Follow the steps to complete the agreement with ease.

- Click ‘Get Form’ button to obtain the form and open it for editing.

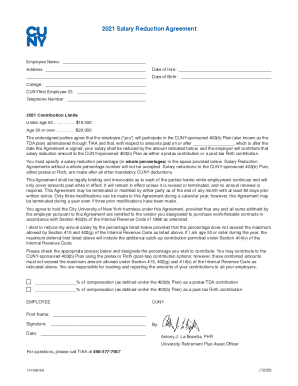

- Begin by completing the employee name and address fields. Make sure to enter the full legal name and a current address where you can receive correspondence.

- Fill in your date of hire and date of birth. This information helps verify your employment status and eligibility.

- Enter the name of your college and your CUNYfirst employee ID. These identifiers link your agreement to your specific employment record.

- Complete the telephone number field so that you can be reached for any potential questions regarding your agreement.

- Review the 2021 contribution limits and ensure your selected percentage does not exceed these limits, based on your age.

- In the specified field, input the exact percentage of your salary you wish to reduce for both pretax and Roth contributions. Ensure these percentages are whole numbers.

- Read the agreement carefully to understand your rights and obligations. Confirm your understanding by signing and dating the form.

- After reviewing all entries for accuracy, save your changes. You can choose to download, print, or share the agreement as needed.

Complete your CUNY Salary Reduction Agreement online today to ensure you maximize your retirement contributions.

A salary reduction contribution plan allows employees to reduce their taxable income by investing for retirement. So an employee's salary isn't really reduced; rather the employer deducts a percentage of their salary and deposits the funds in a retirement savings plan so the money can grow tax deferred.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.