Loading

Get Uk Hmrc C384 2019-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK HMRC C384 online

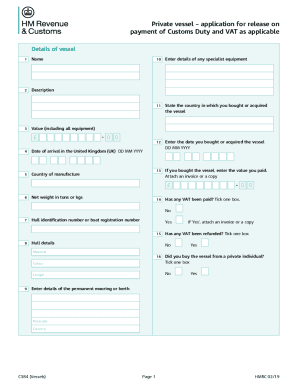

Completing the UK HMRC C384 form is essential for the application of release on payment of customs duty and VAT for your private vessel. This guide will take you through the process step by step, ensuring that you have the necessary information at your fingertips.

Follow the steps to accurately complete the form.

- Press the ‘Get Form’ button to access the form and open it in the editor.

- In the 'Details of vessel' section, enter the name of your vessel in the designated field.

- Provide a brief description of the vessel, including any specifications or unique features.

- Enter the details of any specialist equipment the vessel may have, if applicable.

- Indicate the country where you purchased or acquired the vessel.

- State the total value of the vessel, including all equipment, using pounds (£).

- Fill in the date of arrival in the UK, following the DD MM YYYY format.

- Identify the country of manufacture of the vessel.

- Enter the date you bought or acquired the vessel, also in DD MM YYYY format.

- If you purchased the vessel, enter the value paid and attach an invoice or a copy as supporting documentation.

- Provide the net weight of the vessel in either tons or kilograms.

- Tick the appropriate box to indicate whether any VAT has been paid and attach supporting documentation if 'Yes' is selected.

- Tick the box regarding whether VAT has been refunded and attach supporting documentation if applicable.

- Indicate if the vessel was bought from a private individual by ticking the appropriate box.

- Enter details of the permanent mooring or berth, including postcode and country.

- In the declaration section, affirm the accuracy of the information provided, ensuring your full UK address is listed.

- Sign and date the declaration in the DD MM YYYY format.

- Provide your contact phone number.

- Once you have completed the form, send it along with any associated documents via email or postal mail as outlined.

- Finally, save your changes and download, print, or share the form as necessary.

Take action and complete your documents online with confidence.

Get a European Certificate of Conformity from the manufacturer to show you have approval for an EU-registered vehicle. If it's a left-hand drive vehicle, you'll also need a certificate of GB conversion Individual Vehicle Approval ( IVA ).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.