Loading

Get Declaration Of Tax Residence For Entitiespart Xix Of The Income Tax Act

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Declaration of Tax Residence for Entities Part XIX of the Income Tax Act online

The Declaration of Tax Residence for Entities is a crucial document for entities looking to comply with tax regulations. This guide provides clear, step-by-step instructions on how to accurately fill out this form online to ensure smooth processing by financial institutions.

Follow the steps to successfully complete the form online.

- Press the ‘Get Form’ button to access the Declaration of Tax Residence for Entities and view it in your selected online platform.

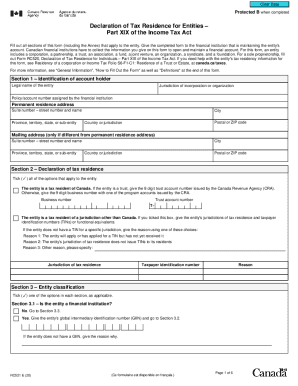

- In Section 1, provide the identification details of the account holder. This includes the legal name of the entity, jurisdiction of incorporation or organization, the policy/account number assigned by the financial institution, and permanent residence address. If the mailing address differs, include that information as well.

- Move to Section 2 and check (✓) all applicable declarations regarding tax residence. If the entity is a tax resident of Canada, provide the 8-digit trust account number or the 9-digit business number issued by the Canada Revenue Agency (CRA). If a jurisdiction outside Canada is applicable, list the jurisdictions and taxpayer identification numbers (TINs) or provide reasons for absence of a TIN.

- In Section 3, classify the entity by ticking the appropriate options. Determine whether the entity is a financial institution requiring a global intermediary identification number (GIIN). If applicable, provide the GIIN or reasons for absence.

- Continue with Sections 3.3 and 3.4, indicating if the entity meets the conditions of a strata/condominium corporation or if it is engaged in active trade or business. Follow the instruction specified for each classification.

- In Section 4, the authorized signing officer must certify that the provided information is complete and accurate. Fill in the authorized person's name, signature, office position, and the date of certification.

- If applicable, fill out the Annex to identify the controlling persons of the entity, ensuring to include sufficient details as required.

- Review all sections and information for accuracy. Once finalized, you can save your changes, download, print, or share the completed form according to your needs.

Start completing your documents online to ensure compliance and accuracy.

Part XIX of the Income Tax Act sets the rules for the common reporting standard that was developed by the Organization for Economic Co-operation and Development for the automatic exchange of financial account information between tax authorities.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.