Loading

Get Md Rw1124 2009-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MD RW1124 online

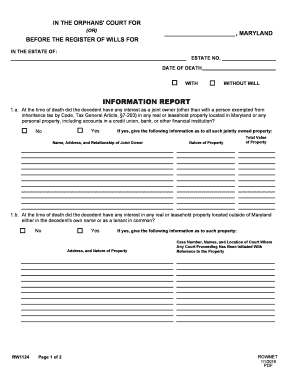

Filling out the MD RW1124 form is an essential step in managing the estate of a deceased individual. This guide provides clear, step-by-step instructions to help users accurately complete the form online with confidence.

Follow the steps to complete your MD RW1124 form successfully.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling out the estate information. Indicate whether the decedent had a will by checking either 'WITH WILL' or 'WITHOUT WILL'.

- In section 1.a, answer the question regarding any joint ownership of property by selecting 'Yes' or 'No'. If 'Yes', provide the required details about the property and joint owners.

- Proceed to section 1.b. Indicate if the decedent had any interest in real or leasehold property located outside of Maryland. Again, select 'Yes' or 'No', and if applicable, fill in the required property information.

- In section 2, answer the question about any transfers the decedent made within two years before their death, checking 'Yes' or 'No'. If 'Yes', enter details for each transfer including recipients and property value.

- Next, respond to the questions regarding any interests in real or personal property that the decedent had at the time of death. Indicate if there were any interests less than absolute.

- In this section, if applicable, provide the detailed information required for each type of interest, including the instrument establishing the interest and information about successors or beneficiaries.

- Finally, complete the affirmation section, signing and dating the document where indicated. Include your contact information such as telephone number, facsimile number, and email address.

- After filling out all the necessary information, review the form for accuracy. Once satisfied, you can save changes, download, print, or share the completed document.

Complete your documents online today for a smooth estate management experience.

While the rule isn't set in stone, the executor's year applies to your “average” estate. For a simple estate, the executor is granted one year from the date of death or one year from probate (more on that later) to distribute assets such as property, gifts, and cash to beneficiaries.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.