Loading

Get Summit Credit Union Cardholder Dispute Form 2012-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Summit Credit Union Cardholder Dispute Form online

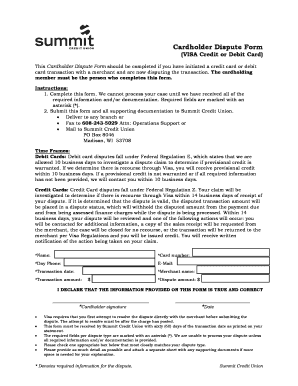

Navigating the dispute process for credit or debit card transactions can be challenging. This guide provides a step-by-step approach to completing the Summit Credit Union Cardholder Dispute Form online, ensuring that you provide all necessary information for a smooth resolution.

Follow the steps to complete your dispute form effectively.

- Press the ‘Get Form’ button to access the Cardholder Dispute Form and open it in your preferred online editor.

- Complete the required fields, denoted with an asterisk (*), including your name, card number, and contact information. Make sure to fill in the transaction date, merchant name, and transaction amount correctly.

- Specify the amount you are disputing in the dispute amount field, ensuring it aligns with the transaction you are contesting.

- Read and acknowledge the statement regarding the accuracy of the information provided. Sign the form electronically if applicable and enter the date of completion.

- Select the appropriate dispute type from the options provided, providing as much detail as possible for your situation. If you need more space, attach additional sheets with your explanations.

- If relevant, provide detailed insights into your attempts to resolve the issue directly with the merchant and include dates of any contact made.

- Once you have completed the form and reviewed it for accuracy, save your changes, and download a copy for your records.

- You may then submit the form along with any supporting documentation to Summit Credit Union via your chosen method: in person at any branch, by fax, or by mail.

Complete your Summit Credit Union Cardholder Dispute Form online today for prompt assistance with your transaction dispute.

The 4 steps to disputing a credit card charge Review the details of the charge. You can review transaction details on your account such as the merchant's name, phone number and your past activity with the merchant. ... You may contact the merchant. ... Gather your evidence. ... Contact your credit card issuer.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.