Loading

Get Mi 3372 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI 3372 online

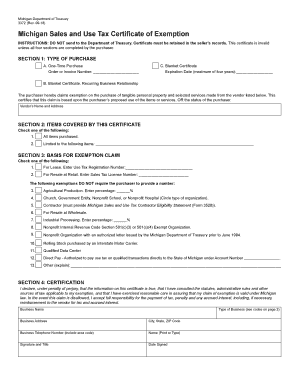

Filling out the MI 3372, the Michigan Sales and Use Tax Certificate of Exemption, is a straightforward process designed to help users claim an exemption from sales and use tax on qualified transactions. This guide provides step-by-step instructions to ensure you complete the form accurately and effectively.

Follow the steps to complete the MI 3372 online.

- Click ‘Get Form’ button to obtain the certificate and open it in your preferred editor.

- In Section 1, select the type of purchase by checking the appropriate box. Indicate 'One-Time Purchase' or 'Blanket Certificate' and fill in any required details such as order number or expiration date.

- Move to Section 2 and indicate whether the exemption applies to 'All items purchased' or specific items only. If limited, list the covered items in the designated area.

- Proceed to Section 3 to select the basis for the exemption claim. Check the relevant box and provide additional information like tax registration numbers where applicable. If the exemption isn’t listed, choose 'Other' and specify the qualifying exemption.

- In Section 4, declare the business type by selecting the appropriate code from the provided list or explain your business type if not listed. Fill in your business name, address, city, state, ZIP code, telephone number, and provide your printed name, signature, title, and the date.

- Ensure all sections are fully completed. Save your changes, then download, print, or share the completed form as needed.

Complete your MI 3372 form online today to take advantage of the exemption!

The exemption amount is $5,400 per year times the number of personal and dependency exemptions allowed under Part 1 of the Michigan Income Tax Act. An employee may not claim more exemptions on the MI-W4 than can be claimed on the employee's Michigan income tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.