Get Tsp-19 2019-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TSP-19 online

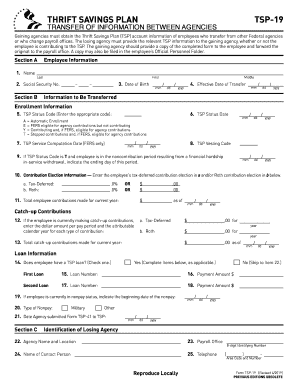

The TSP-19 form is an essential document for transferring Thrift Savings Plan account information between federal agencies. This guide provides clear instructions to help you successfully complete the form online.

Follow the steps to complete your TSP-19 form with ease.

- Click ‘Get Form’ button to retrieve the TSP-19 form and open it in your preferred online editor.

- In Section A, enter your personal information. This includes your name, Social Security number, and date of birth, ensuring accuracy to avoid any processing delays.

- Move on to Section B, where you will input information to be transferred. Start with the TSP Status Code, selecting the appropriate code from the list provided, and include the TSP Status Date.

- If your TSP Status Code is 'T' and you have a non-contributing period attributable to financial hardship, indicate the ending date of this period.

- Fill out the total employee contributions made for the current year, including any catch-up contributions, specifying the amounts for each type.

- In Section C, identify the losing agency by entering the agency name, payroll office, contact person’s name, and their telephone number.

Start filling out your TSP-19 form online today for a seamless transfer process.

Deciding on your contribution to the TSP-19 depends on your financial goals, budget, and personal circumstances. It's often recommended to contribute enough to receive any employer matching funds, as this can significantly boost your retirement savings. Consider starting with a percentage of your salary and adjust based on your financial situation over time. Engaging with a financial planner can offer tailored suggestions based on your unique situation.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.