Loading

Get Kubota Consumer Credit Application 2012-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Kubota Consumer Credit Application online

Filling out the Kubota Consumer Credit Application online is a straightforward process that requires attention to detail. This guide will provide you with comprehensive steps to ensure your application is completed accurately and submitted successfully.

Follow the steps to complete your application effectively.

- Press the ‘Get Form’ button to retrieve the application form and open it in your preferred digital editor.

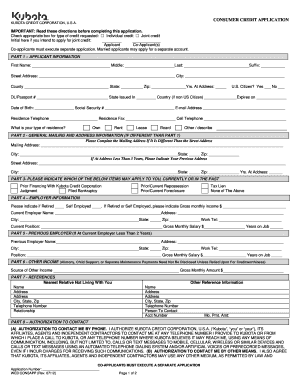

- Begin with Part 1, where you will fill out the applicant information. Provide your first name, middle name, last name, and suffix. Next, enter your street address, city, county, state, and zip code, along with the number of years you have lived at your current address.

- Indicate your U.S. citizenship status by selecting ‘Yes’ or ‘No.’ If you are a non-U.S. citizen, enter your driver's license or passport number, the state it was issued in, and the expiration date.

- Next, enter your date of birth and social security number. Provide your email address, along with your residence telephone, fax number, and mobile number.

- Specify your type of residence by selecting from options such as 'own,' 'rent,' 'lease,' 'board,' or 'other.' If you chose 'other,' provide a brief description.

- Proceed to Part 2, where you will complete the general mailing and address information if it differs from the information provided in Part 1. Fill out the mailing address, city, state, and zip code.

- If you have lived at your current address for less than three years, please provide your previous address details in the provided fields.

- In Part 3, select any past or current situations that apply to you, such as prior financing with Kubota, judgments, bankruptcies, repossessions, foreclosures, or tax liens. Choose 'None of the above' if applicable.

- In Part 4, provide employer information. Indicate if you are retired or self-employed and share your gross monthly income if applicable. Fill out the current employer's name, address, city, state, zip, work telephone, current position, gross monthly salary, and how long you have been employed.

- If you have been at your current employer for less than two years, provide details of your previous employer, including the employer's name, address, and your position.

- In Part 6, disclose other sources of income, if any, that you wish to include, along with the gross monthly amount.

- Part 7 requires references. Enter the name, address, telephone number, and relationship for your nearest relative not living with you. Additionally, provide information for other references, if applicable.

- In Part 8, read and understand the authorization to contact and agree to the terms provided. You may want to consult the information to know your rights regarding contact options.

- Once all sections are filled, review your application for accuracy. After confirming all information is correct, save your changes, download, print, or share the form as necessary.

Complete your Kubota Consumer Credit Application online today for a smoother financing experience.

Related links form

To get a tractor with bad credit, start by researching lenders who specialize in financing for those with less-than-perfect credit. You can improve your chances by providing proof of income and a stable job. Completing a Kubota Consumer Credit Application can also present your case to lenders and may lead to better financing options.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.