Loading

Get Ok Substitute W-9 Form 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OK Substitute W-9 Form online

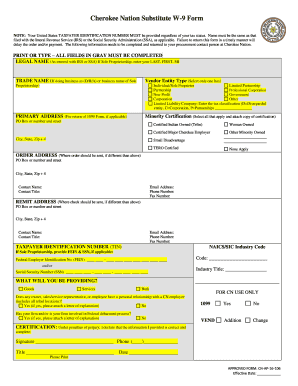

Completing the OK Substitute W-9 Form online is an essential step for individuals and businesses working with the Cherokee Nation. This guide will help you through the process to ensure accurate submission and compliance.

Follow the steps to complete the OK Substitute W-9 Form online

- Press the ‘Get Form’ button to access the OK Substitute W-9 Form and open it in your preferred editor.

- Begin by filling out the 'Legal Name' field, ensuring that it matches the name registered with the Internal Revenue Service (IRS) or the Social Security Administration (SSA). If you are a sole proprietorship, enter your last name, first name, and middle initial.

- Complete the 'Trade Name' section if you are doing business under a different name. Include 'Doing Business As' (D/B/A) if applicable.

- Select one box under 'Vendor Entity Type' that accurately describes your business structure. Options include Individual/Sole Proprietor, Limited Partnership, Partnership, Professional Corporation, Non-Profit, Government, Corporation, or Limited Liability Company (LLC). If you select LLC, also indicate your tax classification if applicable.

- Provide your primary address, including a PO Box or street address, city, state, and ZIP code. This will be used for any return of 1099 forms, if required.

- Complete the 'Minority Certification' section by selecting applicable certifications and attaching the necessary documentation.

- Fill out the 'Order Address' if it differs from your primary address. Include the contact person's name and title, along with a valid email address and phone number.

- Provide the 'Remit Address' if it is different from your primary address. Complete the contact information as needed.

- Enter your Taxpayer Identification Number (TIN) and, if applicable, provide your Federal Employer Identification Number (FEIN) and/or Social Security Number (SSN) as requested.

- Specify what services you will provide by checking the appropriate box: Goods, Services, or Both.

- Answer the questions regarding any personal relationships with Cherokee Nation employees and any involvement in the federal debarment process. If applicable, attach letters of explanation.

- Finally, certify your information by signing the form, providing your title, and writing the date. Make sure to print your name clearly.

- After completing the form, you can save your changes, download, print, or share the document as needed.

Start filling out the OK Substitute W-9 Form online today to ensure a smooth process with the Cherokee Nation.

If you are an independent contractor without a business, you will still need to fill out a W-9 as an individual, a sole proprietor, or a single-member LLC. Simply fill under your name and SSN to file form W-9 without a business.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.