Get Nm Rpd-41379 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NM RPD-41379 online

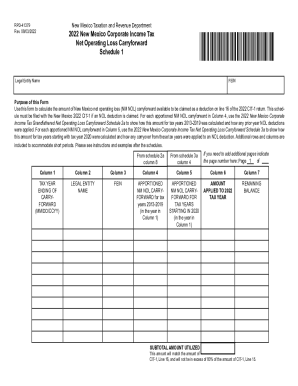

This guide provides detailed instructions on completing the NM RPD-41379 form for the 2022 New Mexico corporate income tax net operating loss carryforward. Users with varying levels of experience will find the step-by-step approach helpful in navigating the online filing process.

Follow the steps to accurately complete your NM RPD-41379 form online.

- Use the ‘Get Form’ button to obtain the NM RPD-41379 form and open it within your digital environment.

- Begin by entering your legal entity name in the designated field at the top of the form.

- Provide your Federal Employer Identification Number (FEIN) in the appropriate section following the legal entity name.

- Complete Schedule 1 by filling out the tax year ending for the carryforward in Column 1. Use the format MM/DD/CCYY.

- In Column 2, enter the legal entity name for each year listed under Column 1, ensuring accuracy in naming.

- Input the corresponding FEIN in Column 3 that matches the legal entity listed in Column 2.

- Fill in Column 4 with the apportioned NM NOL carryforward for tax years 2013-2019 relevant to each legal entity listed.

- In Column 5, indicate the apportioned NM NOL carryforward for tax years beginning in 2020.

- Enter the amount applied to the 2022 tax year in Column 6 as indicated on your calculations.

- Lastly, calculate the remaining balance in Column 7, which should be the total of Columns 4 and 5 minus Column 6, and ensure it matches the subtotal amount utilized accurately.

- After completing the form, be sure to save your changes, download for your records, print, or share as needed.

Complete your NM RPD-41379 form online with confidence and ensure your submissions are accurate.

Fill NM RPD-41379

If applicable, submit this worksheet with your income tax return attached to Form RPD41379. Name. Form RPD-41379 print requirements. To print Form RPD-4379, New Mexico Net Operating Loss (NOL):. Purpose of this Form. Affidavit to Obtain Refund of NM Tax due a Deceased. New Mexico NOL statement print requirements. Since NM has its own NOL form RPD-41379, the common state tracking detail is no longer needed and has been removed. Use NOL Carryforward Schedule 1 to determin the amount of the NM NOL Carryforward. Legal Entity Name. FEIN. Use this page if additional space is needed to report gross receipts from multiple locations.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.