Loading

Get Sc Schedule Nr 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC Schedule NR online

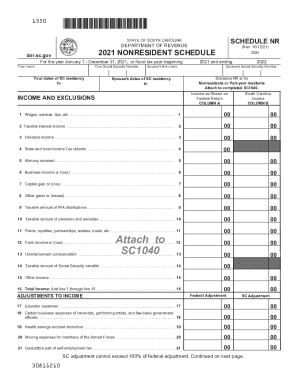

Filling out the SC Schedule NR is essential for nonresidents and part-year residents of South Carolina to report their income accurately. This guide will provide clear, step-by-step instructions on how to complete the form online, ensuring you have all the necessary information at your fingertips.

Follow the steps to complete the SC Schedule NR accurately and efficiently.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your name and Social Security number in the designated fields. Also, indicate your dates of residency in South Carolina.

- If applicable, fill in your spouse’s first name and Social Security number along with their residency dates.

- Move on to the income section. For each type of income listed (wages, interest, dividends, etc.), enter the amounts in Column A, 'Income as Shown on Federal Return,' and Column B, 'South Carolina Income.'

- Proceed to the adjustments section. For each eligible adjustment, enter the amounts in the corresponding lines in both columns where required.

- Continue to the South Carolina adjustments section and fill in the appropriate additions and subtractions, making sure to follow any specific instructions provided.

- Calculate your total South Carolina adjustments and modified adjusted gross income as instructed on the form.

- If you are taking the standard deduction, enter the amount as directed. If itemizing, refer to the appropriate sections to ensure you complete this accurately.

- Finally, subtract allowable deductions from your SC modified adjusted gross income to determine your South Carolina taxable income.

- Once you have filled out all sections, review your entries for accuracy. You can then save changes, download, print, or share the completed form as needed.

Start completing your SC Schedule NR online today to ensure your tax filings are accurate and timely.

Generally, NRA withholding describes the withholding regime that requires 30% withholding on a payment of U.S. source income and the filing of Form 1042 and related Form 1042-S. Payments to all foreign persons, including nonresident alien individuals, foreign entities and governments, may be subject to NRA withholding.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.